Roofing projects can be costly, but there are ways to save money and make your investment more affordable. One of the best ways to do this is by taking advantage of tax credits and rebates that are available for energy-efficient roofing materials. In this blog post, we’ll explore some of the most popular tax credits and rebates that you can use to reduce the cost of your roofing project.

Federal Tax Credits

The federal government offers tax credits for homeowners who install energy-efficient roofing materials on their homes. These tax credits can be worth up to 10% of the cost of the materials, up to a maximum of $500. To qualify for the tax credit, your roofing materials must meet certain energy-efficiency requirements and be installed by a licensed contractor. Some of the most popular energy-efficient roofing materials that qualify for the tax credit include metal roofs, cool roofs, and roofs with high solar reflectance.

State and Local Rebates

In addition to federal tax credits, many states and local utility companies also offer rebates for energy-efficient roofing materials. These rebates can be worth hundreds of dollars and can significantly reduce the cost of your roofing project. To find out if your state or local utility company offers rebates, visit their website or contact them directly.

Tips for Saving Money on Your Roofing Project

By taking advantage of tax credits and rebates, you can save a significant amount of money on your roofing project. Here are a few tips to help you get the most out of these programs:

- Do your research: Make sure to research the tax credits and rebates that are available in your area before you start your roofing project.

- Choose energy-efficient materials: To take advantage of tax credits and rebates, you must install energy-efficient roofing materials. Make sure to choose materials that meet the required energy-efficiency standards.

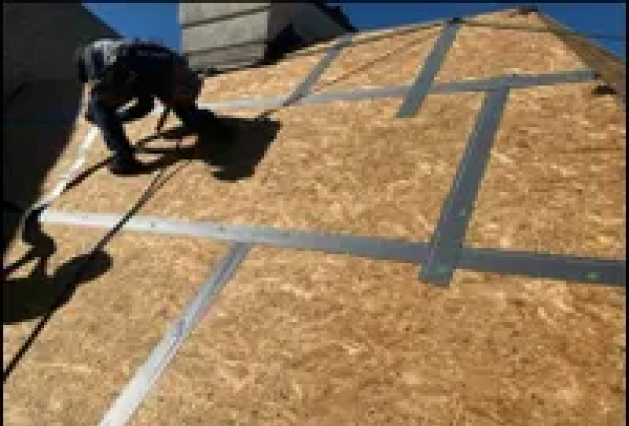

- Hire a licensed contractor: To qualify for tax credits and rebates, your roofing materials must be installed by a licensed contractor. Make sure to hire a professional who is qualified and experienced.

- Keep receipts and documentation: To claim tax credits and rebates, you must have proof of the materials and labor costs for your roofing project. Make sure to keep all receipts and documentation, and consult with a tax professional if necessary.

In conclusion, by taking advantage of tax credits and rebates, you can save a significant amount of money on your roofing project. Do your research, choose energy-efficient materials, hire a licensed contractor, and keep receipts and documentation to get the most out of these programs.